Coverage Levels and Premiums

There are different pricing options and coverage levels available to best suit the needs of your farm. To discuss the details of your premium and the Crop Insurance options available, please contact your local SCIC office or call us toll-free at 1-888-935-0000.

Coverage and premium are individualized to your operation. Coverage reflects each producer’s production records and premium reflects each producer’s claim history.

Coverage Levels

For most crops, you can select coverage at 50, 60, 70 or 80 per cent of your average yield.

Coverage is only available up to 70 per cent for the following crops: alfalfa seed, caraway, chickpeas, coriander, dry beans, khorasan wheat, potatoes, timothy hay, honey, soybeans, hemp, camelina, grain corn and wild rice.

Premium

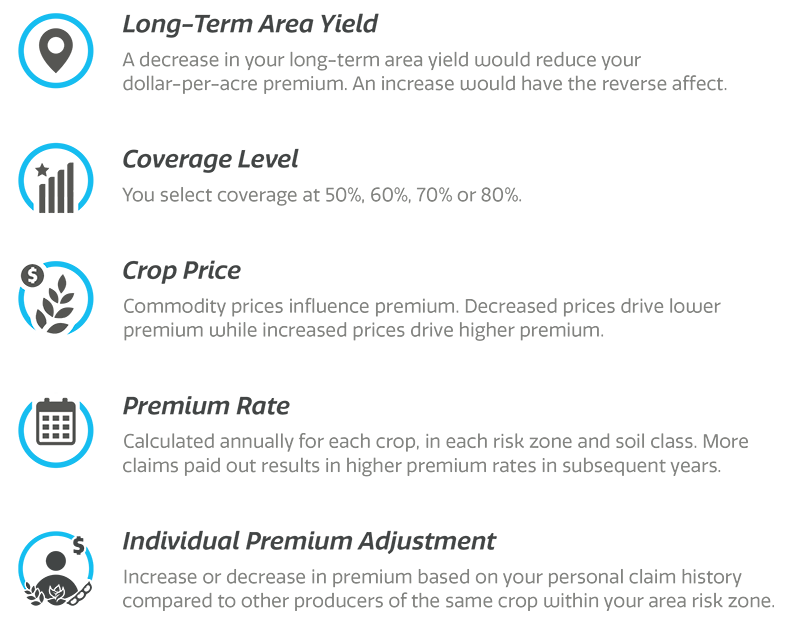

Premium for multi-peril Crop Insurance coverage includes your Long-Term Area Yield, selected coverage level, crop price, premium rate and your Individual Premium adjustment. Premium is only charged on the actual acres seeded and selected to insure. You may endorse all crops and if you do not grow them, premium is not charged.

Premium rates are updated annually on a crop and risk-zone basis. Risk zone rates are based on the claim payment history specific to each crop and risk zone. There is a one-year lag in the information used.

SCIC sets premium rates to recover losses (claims paid) over the long-term and to maintain a sustainable program by paying off program debt and building a reasonable reserve. The methodology used by SCIC to calculate premium rates and yields must be certified by an actuary and approved by Agriculture and Agri-Food Canada every five years. Premium dollars are not used to pay for program administration. The full cost of program administration is shared by the federal and provincial governments.