Processing Applications

SCIC requires financial and supplemental information to calculate program benefits.

Allowable Income and Expense

Allowable income and expense are those directly related to producing and selling agriculture commodities.

Individuals (sole proprietors) must provide the income and expense information on the T1163 and T1164 forms and submit them to the Canada Revenue Agency. This information is then forwarded to SCIC for the AgriStability Program. SCIC also accepts individual producers' income and expense information through AgConnect.

Corporations, co-operatives and other entities are to submit all of their income and expense information directly to SCIC using AgConnect or the Corporations, Co-operatives and Other Entities form.

You must submit your tax information to the Canada Revenue Agency for income tax purposes.

Supplemental Information

The additional information used to adjust your program margin is called supplemental information. This information includes changes in your inventory, accounts payable, accounts receivable, purchased inputs and deferrals. AgriStability adjusts program margins using supplemental information to ensure the program margin represents the overall financial view of your farming operation.

Supplemental information is submitted directly to SCIC through AgConnect or on the appropriate form:

- For individuals (sole proprietors) - Supplemental Information form

- For corporations, co-operatives, other entities - Corporations/Co-operatives/Other Entities form

| Allowable Income |

|---|

| Agricultural commodity sales |

| Crop Insurance proceeds |

| Canadian Food Inspection Agency (CFIA) |

| Commodity future gains |

| Custom feeding* |

| Insurance and other proceeds for allowable income and expense items |

| Rebates for allowable expense |

| Specified program payments** |

| Wildlife damage compensation |

| Allowable Expense |

|---|

| Agricultural commodity purchases |

| AgriInsurance premiums |

| Commissions and levies (related to commodity sales) |

| Commodity future losses/transaction fees |

| Containers and twine |

| Custom feeding* |

| Electricity |

| Fertilizer and lime |

| Freight and shipping (to and from market) |

| Heating fuel |

| Machinery (gasoline, diesel fuel, oil) |

| Minerals and Salts |

| Other insurance/premiums for allowable income and expense items |

| Pesticides |

| Point of sale adjustments |

| Prepared feed |

| Salaries (arms length as defined by CRA) |

| Storage/drying |

| Veterinary fees, medicine, breeding fees |

*Custom feedlot income and expense are allowable if the feedlot makes an appreciable contribution to the growth and maturity of the livestock. For example, in the case of cattle, the animals must be fed for more than 60 days or have an average gain of at least 90kgs (200 lbs.).

**To determine whether or not to include a program payment in allowable income in the program year and/or reference period, Participants reporting tax in Saskatchewan should refer to the Canada Revenue Agency's RC4060 Farming Income and the AgriStability and AgriInvest Program Guide.

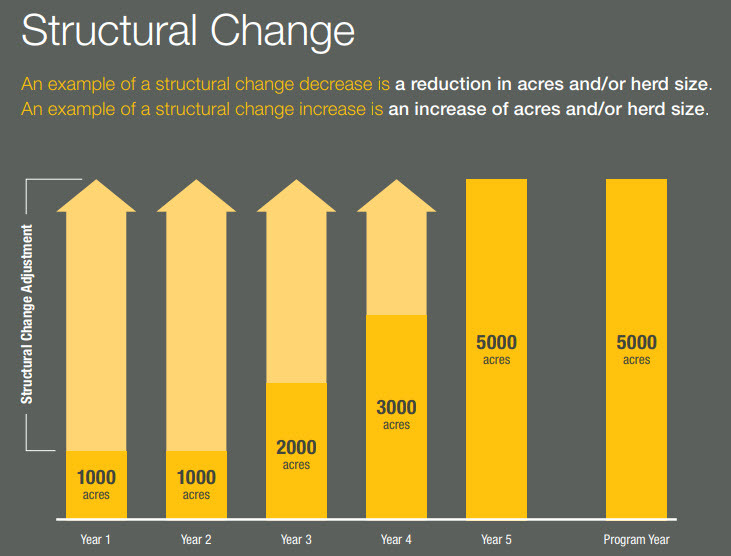

Structural Change

From time to time, your farming operation size may change. This could include expanding acres, reducing acres, growing something new, reducing herd sizes, etc. and are considered a structural change.

When a structural change occurs, your farming operation's income and expense will be different than what occurred in the past. As a result, your farm's historical reference margin is no longer a good comparison for the current program margin.

To provide a more accurate comparison, AgriStability adjusts your farming operation's reference margin to reflect your farm size and type in the program year.

Calculating Structural Change

Each year SCIC reviews your file to determine whether a structural change adjustment is necessary. For each year in your reference margin, an adjustment is made based on your farming operation's current productive units. This calculation ensures your historical reference margin is an accurate reflection of what the margin would have been, had your operation remained the same size and scale as in the program year. If the structural change represents $5,000 and at least 10 per cent difference in your margin, it will be subject to structural change adjustments.

Combining Operations

SCIC encourages you to indicate if your operations should be combined. SCIC will also combine operations where it is determined the entities are a part of a whole farm, even if reporting separately for income tax purposes. SCIC considers the following criteria when entities should be combining operations:

- the operations are not legally, financially or operationally independent; or

- all or some of the transactions between the operations are above or below fair market value.

By combining operations that are not independent of each other, SCIC ensures AgriStability benefits are directed to producers experiencing a decline in their program margin beyond their control.

Deeming Crop Insurance Benefits

If you did not participate in the Crop Insurance Program, you may have your AgriStability benefit reduced. This reduction occurs only in cases where you have a negative program year margin and do not have Crop Insurance at the 70 per cent coverage level. In those circumstances, you will have the negative portion of your program year margin benefit reduced by 70 per cent of a "deemed Crop Insurance benefit."

The deemed Crop Insurance benefit represents the claim you would have received, had you participated in Crop Insurance, less the premium you would have paid to participate in the Program.

Request For Information

Incorrect information can impact the calculation of future benefits even if you are not in a claim position for that year.

When SCIC staff are reviewing and processing AgriStability files, an adjustment to your information is sometimes required. For example, SCIC may identify differences between your sales and inventory figures which require clarification. If this occurs, you and/or your contact person will be asked to provide additional information to clarify the reported figures. When SCIC requests additional information to process a file, it is important to provide that information within the required time frame. If the information is not provided, your file will be considered incomplete and a Calculation of Benefits will not be generated until the information is received.

Additionally, as reference margins are calculated based on historical information, incorrect information can impact the calculation of future benefits – even if you are not in a claim position for that year. It is important to keep your information up-to-date as this will ensure timely processing of your applications.