Margins

Whether it is a decline in commodity prices due to market disruptions, a lack of production because of unfavourable weather, or quality losses caused by challenging harvest conditions, AgriStability can help cover those losses.

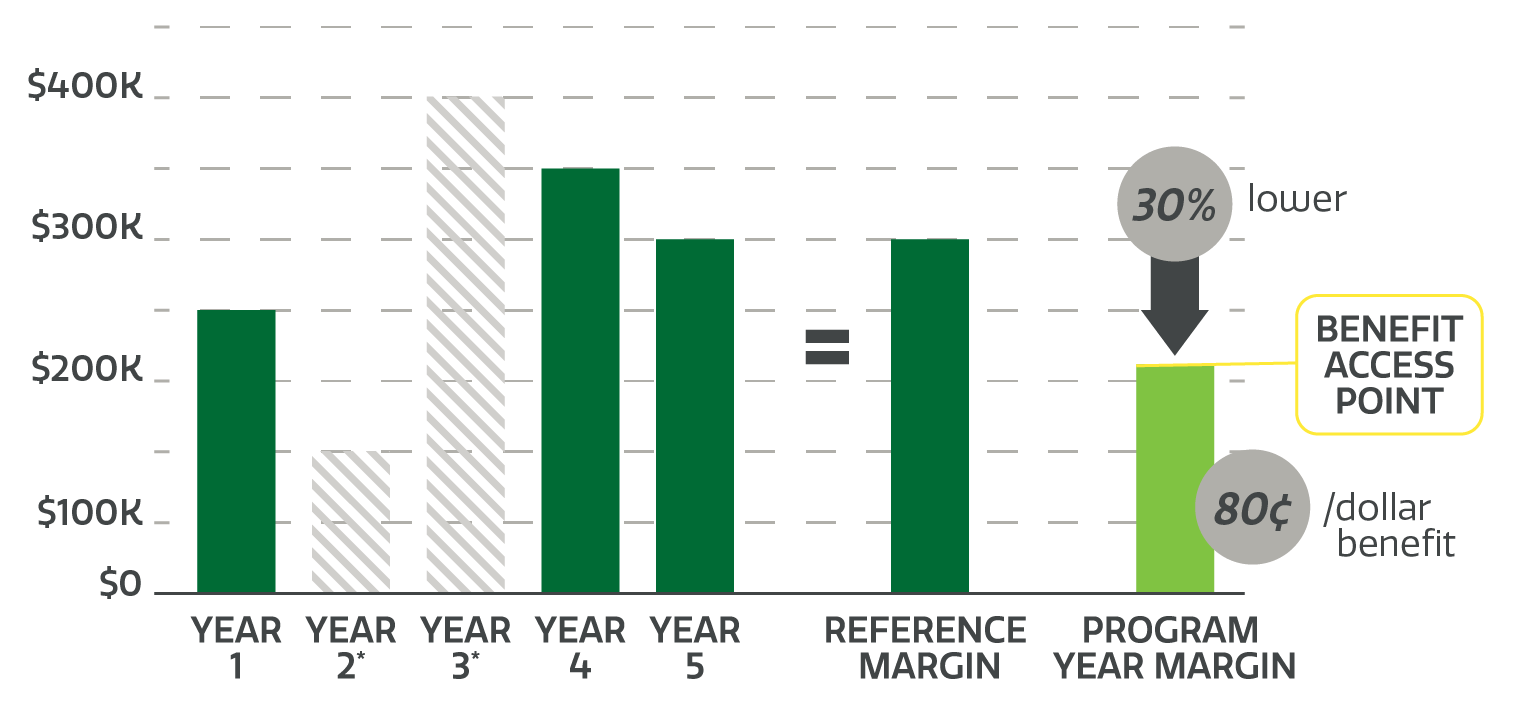

The AgriStability Program uses margins to determine if you are eligible for benefit payments. AgriStability calculates a program year margin and compares this to the reference margin for your farming operation.

Triggering a Payment

If your program year margin falls 30 per cent below your reference year margin, due to any combination of production loss, adverse market conditions or increased costs, AgriStability could provide a payment of 80 cents for every dollar of decline. In 2023, the compensation rate increased from 70 per cent to 80 per cent.

Program Year Margin

The current year's financial profile for your farm or ranch is called the program year margin. Your program year margin is calculated each year. It is based on the income and expenses directly related to the farming operation and includes accrual adjustments.

Allowable income and expenses ensure AgriStability coverage is restricted to production or price declines, rising input costs and market losses.

The program year margin also includes accrual adjustments that measure changes in the value of a producer's accounts receivable, accounts payable, purchased inputs, deferrals and commodity inventories. Inventory changes are valued using fair market values. Essentially, if your farm's inventory value increases, it increases the program year margin; if your farm's inventory value decreases, it decreases the program year margin.

Reference Margin

Your historical financial information is used in the Calculation of Benefits to accurately reflect your farming operation.

Your program year margin is compared to your reference margin from the previous five years. The reference margin is determined by excluding the highest and lowest margins in the previous five years and averaging the remaining three years.

If your farm or ranch is newly enrolled in AgriStability or in operation for less than five years, the reference margin will be based on the three most recent margins (if available). If three years are not available, the reference margin will be based on industry averages and standards. New participants will only be required to submit the previous three years of historical financial information as well as the supplemental information.

Negative Margins

A negative program year margin occurs if your allowable expenses exceed your allowable income after adjustments for changes in inventory valuation, receivables, payables and purchased inputs. Negative margins are protected under the AgriStability Program.